Breaking Down the 2018 Tax Changes on Real Estate

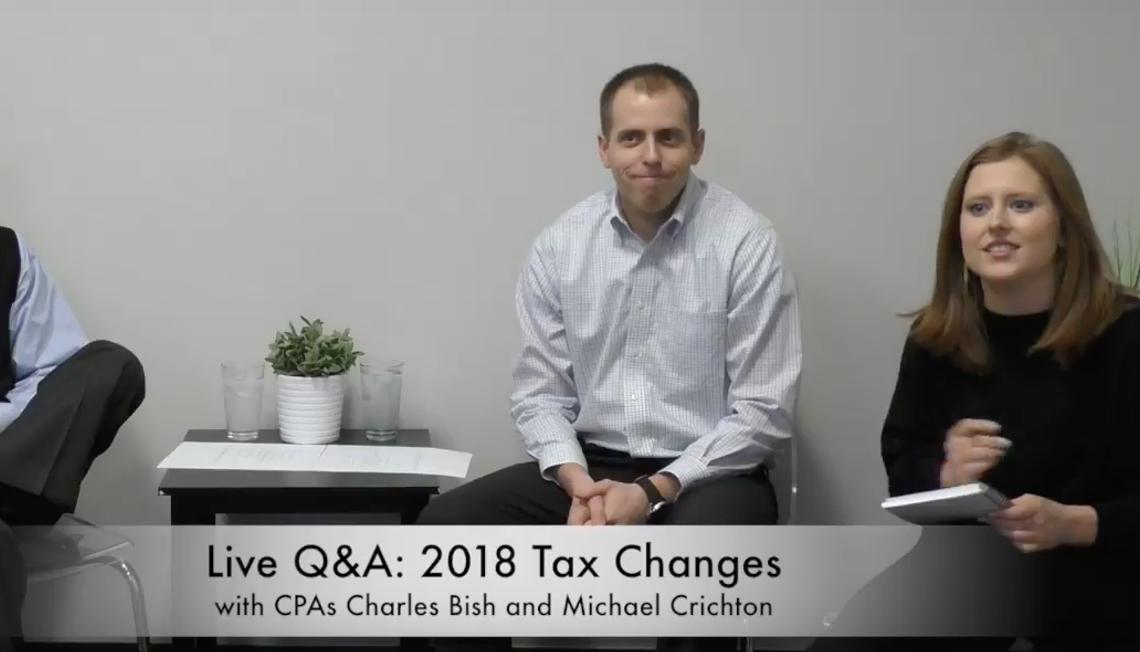

Yesterday the Keri Shull Team welcomed CPAs Charles Bish and Michael Crichton from Burdette Smith & Bish LLC for a Facebook Live Q&A to discuss the new 2018 Tax Plan and its effect on the real estate market, as well as to answer some audience questions.

Highlights from the Q&A

Overview of the Tax Bill

Michael: The new tax bill will go into effect on January 1st, 2018 and the biggest change, as far as potential homeowners and current homeowners are concerned, is the increase in the standard deduction. The standard deduction increase for a single file is at $12,000, and for married or joint file is $24,000.

Charles: One of the other major changes was the SaLT, the State and Local Tax limitation to $10,000, which will affect a lot of people in our Washington D.C., Maryland area just because we ran a somewhat high real estate and income tax situation, so that’ll probably be one of the things we have to watch for.

Michael: Right. And one thing that the new bill kept was the exclusion on the gain and sale of your home. So, if you’re a homeowner, and you’ve lived in the home for two years out of a five year period, your gain is excluded for up to $250,000 for single filers, and $500,000 for married filers and joint filers.

Mortgage Interest Deductions

Michael: In the old law, the $1 million loan was what you could deduct. Now, the threshold has gone down to $750,000. You’re grandfathered in if you’re a current home owner, but if you are now looking to buy a home, it’s $750,000 loan – not what you pay for the home, but what your loan threshold is. So anything higher than that would be limited cap.

Charles: Right, so if you bought a home for a million and a half, and had a million dollar mortgage on that home, $250,000 of that mortgage would not be subject to interest deductibility, so on a 4% loan that would be a change around $10,000 annually for people that, under the old law buying a home versus the new one.

Property Investment Taxes vs Primary Residence Taxes

Michael: The investment property is treated differently so there’s no cap of the loan, and your taxes and your interests are deductible as well as all the other rental expenses that you have. There’s no cap on the state and local because those are treated under different rules than the primary residence which is capped. The state and local taxes for your personal property are capped now at $10,000.

Does the pass-through deduction apply to income properties?

Charles: Essentially, pass-through entities do enjoy a 20% deduction. We’re still figuring out how that’s going to be worked out, but the thing to keep in mind is, if you’re considered a personal service like CPAs and lawyers and so forth, that they are excluded from the pass-through deduction. But if you have a rental business where you have rental properties, it would not be considered personal service and they very well may be allowed to enjoy the pass-through deductions. There are other limitations on rental properties relating to the passive income rules, which is a different situation as well.

Michael: And the rental property – if you’ve purchased in the name of the homeowner, it’s not affected at all by the pass-through deduction that was part of the new tax bill. Only if a sub-entity was set up, then it potentially could be affected by the pass-through deduction but things are still being ironed out.

State and Local Tax Differences in DC, Maryland, Virginia

VA: Top Rate = 5.75% on income in excess of $17,000

MD: Top rate = 5.75% on income in excess of $250,000

In addition, MD assesses a County (Local) income tax of between 1.75% and 3.2%, depending on county.

Note that the Counties closest to DC have the highest local rates; thus taxpayers in those counties need to add 3.2% to their state income tax rate.

DC: Top rate = 8.95% on income over $1 million

Example: Single taxpayer with $100,000 of taxable income

VA tax = $5,493

MD tax = $4,948 + $3,200 = $8,148

DC = $6,900

* VA does also assess a personal property tax on vehicles, which DC & MD do not. Despite this, VA remains the least taxed of the three.