As sad as it is to say, selling a house isn’t free. There are costs associate with preparing your home for sale, putting it in front of the right buyers, and even finalizing the sale. So, how much does it cost to sell a house, then?

Well, the specific amounts that you pay will change based on the eaxct details of your house. More valuable homes often cost a bit more to sell, while getting your home sold quickly can help alleviate certain expenses. With that said, we wanted to put together a guide to the 7 Costs That You Must Consider when selling your home.

Without further ado, let’s get started!

Home Selling Cost #1: Your Agent’s Commission

Whenever you sell a house with a real estate agent, that agent takes a cut for themselves. This cut, which is called their commission, is the only way that a lot of agents make money — so it’s not surprising that real estate agents are insistent on you paying it!

Rather than being a flat fee, the commission is almost always a percentage of your home’s sale price. So, the more valuable your home sale, the larger their commission will be. There is also no hard-and-fast rule for what that percentage actually is, but you can bet on it being somewhere around 6% of what your home is worth.

The good news is that you don’t usually pay this cost up front. Instead, the listing agent will take their commission fee out of the proceeds of your home sale.

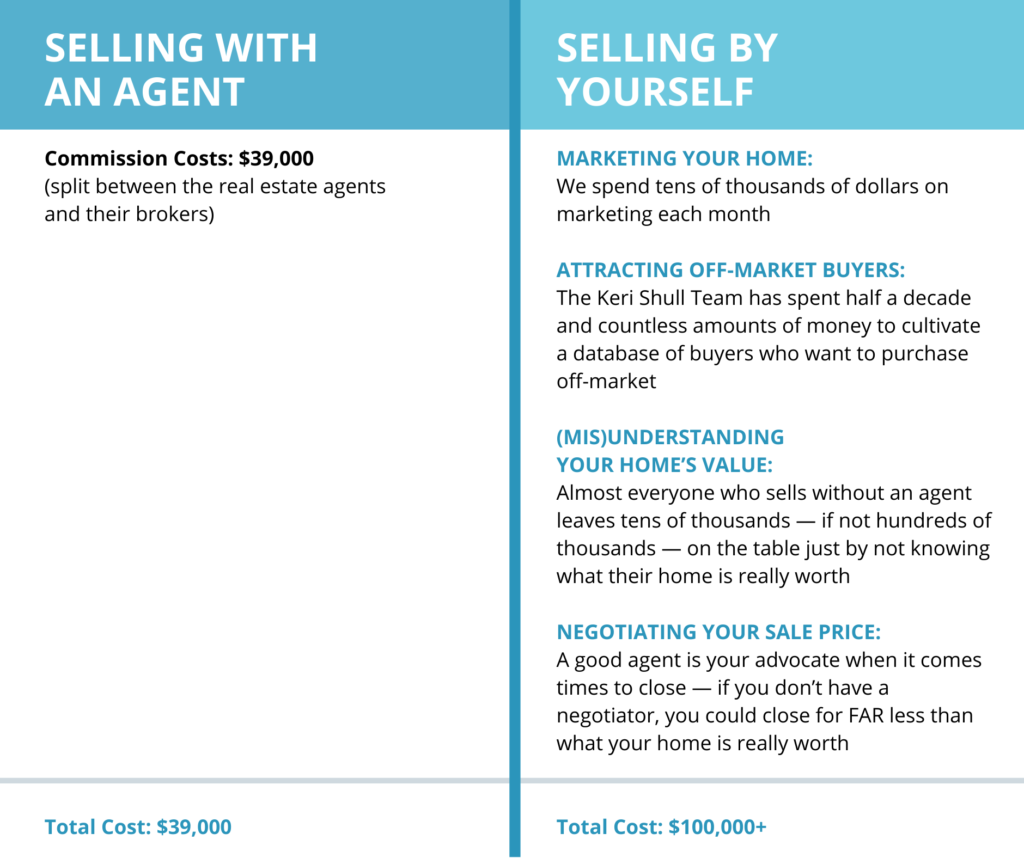

But what if you don’t want to pay out this commission fee? Well, you could always do a For Sale By Owner — let’s compare the costs!

Assuming a Home Value of $650,000

Yeah, we can’t really recommend that you try to go it alone.

As you can see, having the best real estate team on your side is key to keeping your home sale costs as low as possible. If you want to learn more about how our top-selling team can minimize your costs and maximize your profits during a home sale, just contact the Keri Shull Team today!

Home Selling Cost #2: Your Renovation Costs

As frustrating as it may be, it’s important to fix up your home before selling it on the open market. There are certain renovations that will do wonders to attract buyers to your home, potentially even helping drive competing offers on your property.

So, how much are these renovations going to cost you?

Well, it’s a bit difficult to give a concrete answer on that front. The fact of the matter is that every home is different — and every home is going to need different renovations and remodels to maximize its value!

There are two ways for you to figure out more exactly what your specific renovation costs are going to be:

1. Work With the Best Agent In Your Area

A good real estate team will have a finger on the pulse of what buyers in your market want. This means that they will be able evaluate your home, figure out what renovations would be best (as well as the renovations that would not pay off), and show you how to maximize your specific home’s value.

2. Get a Good Home Inspection

If an agent will help figure out the style and features that you should add to your home, the home inspection will indicate the things that you need to fix in your home. Of course, an inspection is another cost…

Home Selling Cost #3: The Home Inspection

Home inspections are often an optional expense for the property owner. So why would you ever choose to spend the extra dough on an inspection?

The short answer? Because the buyer might. And if the buyer calls for their own inspection, it could reveal issues in your house that could cause extra repair costs or delay the sale of your home. Both of these are outcomes that could cost you a ton of money, so it’s best to be proactive and avoid them!

In the grand scheme of things, the home inspection is a relatively low cost. The average rate of an inspection for people living in Arlington VA was just $335 in the 2020 real estate market, according to manta.com.

Home Selling Cost #4: The Home Staging

If you want to sell your home for a high price, you want it to sell fast. And if you want to sell your home fast, you want as many people as possible to fall in love with your home.

And if you want both, then you want to make sure you are staging it properly! When you stage a home, it is easier for people to imagine themselves living there — which makes it easier for them to fall in love with the house, too.

Sadly, not everyone is going to love staging like this…

A good professional stager is an investment in your home. DC area stagers average between $300-$500 per room, but the process can net you thousands in extra revenue on your sale. Make sure to speak with your agent to see if they have a relationship with a high-quality stager!

Home Selling Cost #5: Paying Off Your Mortgage

For most people who are selling their home and moving up to a more valuable one, the proceeds of a sale will go towards paying off the remainder on their mortgage. However, there’s a chance that what you owe is actually greater than what it says on your statement. Depending on any prorated interest rates and other factors that can change based on how you got your mortgage, this cost could be higher than you anticipate just based on what you technically owe.

It’s important to rely on experts to help you learn exactly what you owe. If you have a HELOC or Bridge Loan to ease the financial burden of buying and selling at the same time, then it might impose a different payoff rate than if you have a VA-backed loan or other standard home purchase mortgage.

Make sure to speak with your real estate agent and mortgage lender to figure out the precise amount that you will owe.

Home Selling Cost #6: Capital Gains Taxes

In all things, Uncle Sam takes his due — and the same is true when you are selling your home.

No transaction is safe from the IRS.

If you sell your property for more than you paid (and let’s be honest, that is the ultimate goal for most people selling a home), then you are subject to paying a Capital Gains Tax. This tax is a cut of any profit you accrue during a home sale, and it can be a rather hefty fee. Here’s how the Capital Gains Tax works when it comes time to sell your home:

Do I pay Capital Gains on all of the profit?

Luckily, the answer is probably not. If you are filing your taxes as an individual, you could qualify to exclude $250,000 worth of the net gain on your home from your reported income. If you are filing jointly, that qualification could double to $500,000. So, the odds are that you will be able to get a big tax break on most of this income, as long as you meet the qualifications!

So, what are the qualifications? The biggest one is that the property must have been your primary residence for at least 2 years out of the last 5 years. This means that you cannot use this exemption on vacation homes or investment properties — but you can defer capital gains taxes on your investment properties using a 1031 Exchange.

How Much Are Capital Gains Taxes?

Capital Gains Taxes are calculated on a sliding scale based on your income. There are three brackets into which you can fall:

0% Bracket: If your yearly income is below $40,000, then you will pay 0% tax on the profit of your home sale in 2020.

15% Bracket: If your yearly income is between $40,001 and $441,450, then you will pay a 15% tax on any eligible home sale profits in 2020.

20% Bracket: If your yearly income is $441,451 or higher, then you will pay a 20% tax on the taxable proceeds from your 2020 home sale.

It’s important to note that capital gains tax rates can change year-to-year. So if you are trying to decide whether to sell your home now or wait until later, this is one of many factors to keep in mind!

Home Selling Cost #7: Closing Costs

Yes, there a few more costs left, even once you’ve gotten through negotiations and to the closing table. The good news is, there’s a pretty good chance that you might not have to pay these!

Generally, the miscellaneous costs of closing on a home come out to somewhere between 2% and 4% of the sale price. So, using our earlier example of a $650,000 home, the closing costs would likely range between $13,000 and $26,000.

It’s not unusual for these closing costs to be a bartering tool during negotiations. In order to put forth the most attractive offer possible, buyers might include terms to cover the closing costs on their end. In this case, they will typically work the costs into the payments of their mortgage, and you will get the home sold without having to pay closing costs!

Of course, this is a more common occurrence in areas where the home owner has more leverage. So, in sellers’ markets like Washington DC’s hottest neighborhoods, you have a far greater chance of negotiating your way into not paying the closing costs.

Hidden Cost #8: The Opportunity Cost

By far the most expensive cost that you will pay when selling a home is the opportunity cost of not getting what your home is truly worth!

There are countless horror stories online of people selling their house for hundreds of thousands of dollars less than it should sell for, simply because they didn’t take the proper precautions to prevent this loss. So, how are you supposed to make sure you are getting your home’s full value?

Work with a real estate team that can protect you!

If you want to get the most money for your home and avoid any nasty surprises along the way, then you owe it to yourself to work with the Keri Shull Team! Our incredible agents make it their mission to ensure that we sell your home fast, for a great price, and with absolutely zero extra stress!

Are you interested in learning more about how we can help you? Contact the Keri Shull Team today! Just click here to schedule a free consultation with one of our Home Value Analysts today!